Make an impact while planning for your future

We also offer the ability to create a free Revocable Living Trust

Everybody needs a will

Whether you’re 18 or 108, everyone should have a will in place. People use wills to choose who gets their property, name guardians for minor children, provide a plan for pets, and more.

Through a will, many people also choose to leave a part of their estate to Western Carolina University Foundation and make an impact on the causes they love, for years to come.

Why give in your will?

Common gifted assets in wills and trusts

- Financial accounts

- Real estate

- Vehicles

- Brokerage accounts

- Crypto and NFTs

- Personal property

Make your will online – for free!

Western Carolina University Foundation has partnered with FreeWill to offer an online estate planning tool that makes it easy and cost-free to make your plan. In as little as 20 minutes, you can help support our mission for future generations.

We also offer the ability to create a free Revocable Living Trust

Popular resources

Sample bequest language for your will or trust

This language may help you and your attorney as you consider a gift that will meet your financial and personal goals.

Sample codicil

When it’s time to update your will, you can use a codicil—an addition or supplement that explains or modifies your existing will.

Make a Gift…Leave A Legacy

Show your family how much you care by creating or updating your will or estate plan. When you make a gift to the Western Carolina University Foundation through your will, trust, or retirement plan, you’re helping support future Catamounts for years to come. Estate gifts offer creative, flexible strategies for your estate and charitable planning.

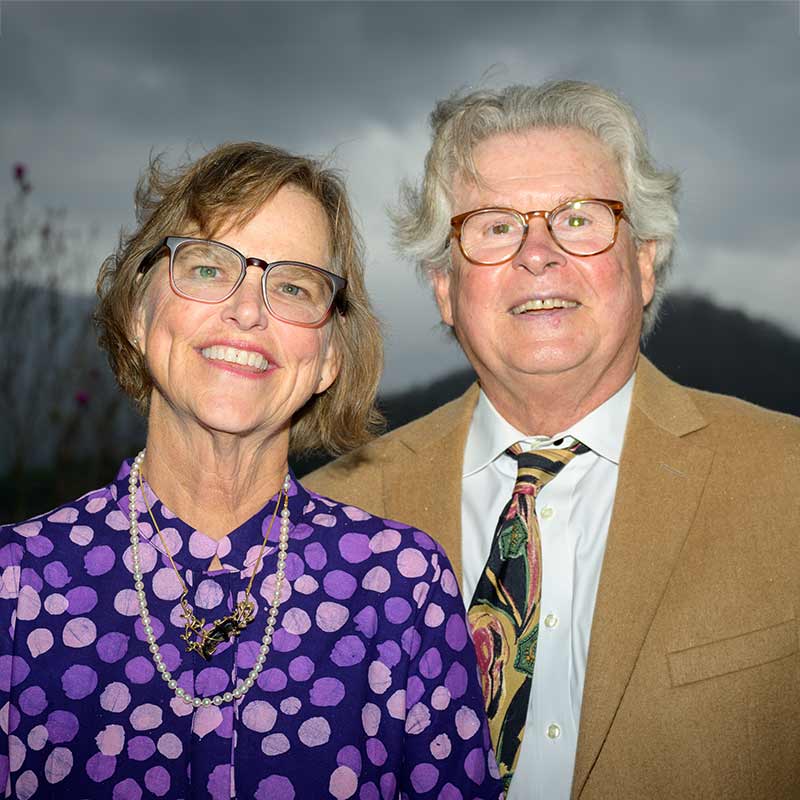

Patrick and Jeanne McGuire

A classroom in Western Carolina University’s Apodaca Science Building has a new name in recognition of a couple’s three-decade record of financial support and in tribute to a family’s history of providing dental services to residents of Jackson and surrounding counties for more than 150 years. The contributions come in the form of a cash gift for the College of Arts and Sciences, and two planned gifts for the Belcher College of Fine and Performing Arts and the College of Education and Allied Professions. The gifts will create three separate funds in each college, known as the Patrick and Jeanne McGuire Legacy Endowments. The funds will provide experiential learning and professional development opportunities for students, faculty, and staff in each college, as well as support for initiatives that enhance the overall quality and reputations of the colleges’ programs and support for initiatives that engage members of the Jackson County community. “Neither Jeanne nor I graduated from Western Carolina University,” he said. “However, I am a WCU alumnus. I spent most of the 1972-1973 school year at Western, as well as numerous summer school sessions taking courses I needed.” He also spent much time on campus as a child and young adult. “My father was a great sports fan and a huge fan of WCU football and basketball,” he said. “I have always loved Cullowhee and Western Carolina University. My one ‘sin’ is that I didn’t graduate from WCU. However, if I had I would never have met Jeanne, and that would easily count as the biggest misfortune of my life. So, I can’t be very sorry.”

Frequently Asked Questions

If you do not have a valid will, an administrator for your estate will be appointed by the court at your family’s expense.

• Your assets will be distributed according to the laws in your state, regardless of your wishes or those of your family.

• If you have no living relatives, the state receives everything you own.

• Your beneficiaries may be responsible for taxes, probate fees, and other expenses that could have been avoided had a valid will been in place.

Yes! Gifts of any size are deeply appreciated. Many people choose to leave a percentage of their estate, which scales up or down with your estate size.

Yes! Knowing in advance about your intentions is quite helpful to our staff, but you are always welcome to not share your gift.

We’ve partnered with FreeWill to help you make a will or trust at no cost to you. You can use this to complete your plans, or you may choose to use the same tools to get your affairs in order before visiting an attorney (who is likely to have a fee associated with finalizing your plans).

Yes. You are always free to revise or update your estate plans.

Yes! FreeWill will never share your personal information without your permission.

All planned gifts should be directed to the Western Carolina University Foundation.

Western Carolina University Foundation address is One University Drive, 201 H.F. Robinson Administration Building, Cullowhee, NC 28723.

Western Carolina University’s Tax ID number is 23-7159170.

SPECIFIC DOLLAR AMOUNT: I hereby give, devise, and bequeath $DOLLARS to the Western Carolina University Foundation, a nonprofit organization located at 201 H.F. Robinson, Cullowhee, NC, 28723, Federal Tax ID #23- 7159170, for the Western Carolina University Foundation’s general use and purpose.

PERCENTAGE OF ESTATE: I hereby give, devise, and bequeath PERCENTAGE OF YOUR ESTATE to the Western Carolina University Foundation, a nonprofit organization located at 201 H.F. Robinson, Cullowhee, NC, 28723, Federal Tax ID #23-7159170, for the Western Carolina University Foundation’s general use and purpose.

SPECIFIC PERSONAL PROPERTY: I hereby give, devise, and bequeath DESCRIPTION OF PROPERTY to the Western Carolina University Foundation, a nonprofit organization located at 201 H.F. Robinson, Cullowhee, NC, 28723, Federal Tax ID #23- 7159170, for the Western Carolina University Foundation’s general use and purposes.

If you are considering a bequest but would like to ensure that your bequest will be used only for a specific purpose, please let us know. We would be happy to work with you and your attorney to help you identify ways to give that will ensure your charitable objectives can be met. We will also work with you and your attorney to craft language to accomplish your objectives.

We’re here to help you meet your goals!

Our team would be happy to speak with you in confidence about your giving goals, with no obligation.

Name: Ben Pendry

Title :Associate Vice Chancellor for Advancement

Phone: 828-227-7124

Email: bjpendry@wcu.edu

Already included us in your estate plan? Let us know

More ways to make an impact

Beneficiary designations

Gifting assets not covered by your will — like 401(k) or IRA accounts — may help your heirs avoid unwanted taxes, even if you’re below the estate tax threshold.

Popular tax-smart gifts

Many people are increasingly choosing to give non-cash assets, so they can have a bigger impact at less cost to them.

Gifts that pay you back

Give assets while providing yourself or others with income for a period of time or distributions at a later date.